Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: What Is A Participating Policy?

Read more »: What Is A Participating Policy?Participating policy – What to expect. A participating policy is an insurance contract that pays dividends to the policy holder. Dividends are generated from the profits of the insurance company that sold the policy and are typically paid out on an annual basis over the life of the policy. Most policies also include a final…

-

Read more »: How To Get Tax Free Death Benefit

Read more »: How To Get Tax Free Death BenefitIf retirement is on the horizon for you or a major milestone you want to achieve, set a clear goal, and plan a reward for achieving it to help motivate you. Instead of planning an age or a date focus on a financial target that will produce the quality of life you are looking for.

-

Read more »: Is Life Insurance Taxable In Canada?

Read more »: Is Life Insurance Taxable In Canada?If retirement is on the horizon for you or a major milestone you want to achieve, set a clear goal, and plan a reward for achieving it to help motivate you. Instead of planning an age or a date focus on a financial target that will produce the quality of life you are looking for.

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

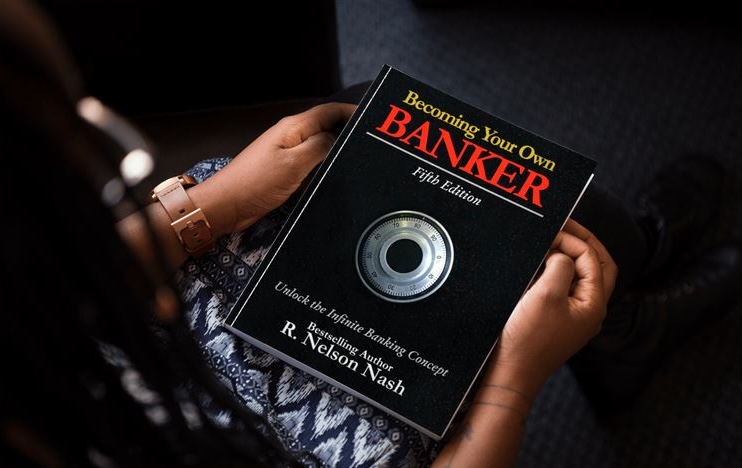

CLICK HERE 👉 http://watchibc.com/ In this episode, we dive deep into the fundamentals of infinite banking and the common misconceptions surrounding cash value life insurance. The discussion centers around R. Nelson Nash’s book Becoming Your Own Banker, emphasizing the difference between purchasing a policy and implementing a banking process. Through the equipment financing example, Jayson…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!