Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Term Insurance vs Life Insurance

Is there a difference between term insurance and life insurance? Good question! Term life insurance is what we commonly think of when term insurance comes up in conversation. However, term insurance is not limited to life coverage or a policy that provides a death benefit. Term insurance is the most common form of insurance in the world…

-

Read more »: Learn More About Your TFSA Contribution 2022

Read more »: Learn More About Your TFSA Contribution 2022The Tax-Free Savings Account or TFSA has become a very popular investing tool for Canadians. The good news for Canadian families is that each adult can contribute another $6000 into their TFSA accounts this year. That is $6000 in total across all accounts. Indeed, you can have multiple accounts, but you are capped to a contribution max. …

-

Read more »: OAS – Old Age Security Canada

Read more »: OAS – Old Age Security CanadaOld Age Security Canada info for 2022 Are you interested in learning what the OAS payout is for 2022? The amount you receive from this Canadian program depends on a few individual factors. Just as well, there are some strategies worth knowing to get the most from your OAS payment. Let’s break down everything your…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE 👉 http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

-

CLICK HERE 👉 http://watchibc.com/ Welcome back to Bankers Vault! Today, we break down the key concepts of financial independence versus financial freedom and introduce the family banking system as a powerful way to control the banking function in your life. We explain how to free up cash flow through debt recapture, build a sustainable system…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

-

Every major purchase comes down to three choices: lease it, buy it with cash, or finance it. Jason Weiss, a financial strategist, breaks down how business owners can optimize their cash flow while acquiring assets. Instead of tying up capital, strategic financing allows you to keep money moving where it works best. This approach applies…

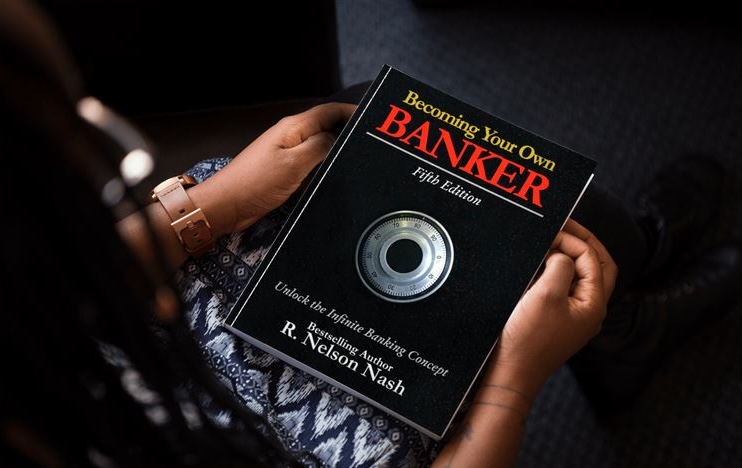

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!