Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Borrowing money from life insurance

Read more »: Borrowing money from life insuranceBenefits of Borrowing money from life insurance The ability to borrow from a life insurance asset, called cash value, has been common knowledge for many years. However, there are many details about the advantages of borrowing from insurance that are unknown to the general public. When used intentionally, borrowing from par whole life insurance can…

-

Read more »: The Secrets to Paid Up Additions

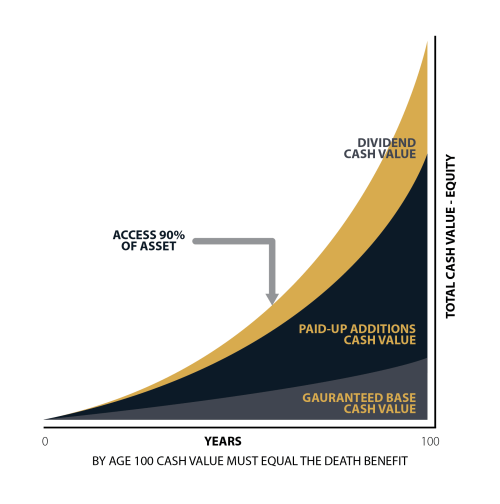

Read more »: The Secrets to Paid Up AdditionsIn this article, we’ll talk about paid-up additions and how it suits this often neglected, and often misunderstood, financial freedom tool known as participating dividend paying whole life insurance coverage.

-

Read more »: Creating A Private Family Banking Strategy

Read more »: Creating A Private Family Banking StrategyWhat is the main cause of concern among wealthy families around the world? Our research shows that families who are remarkably wealthy are keen and deeply concerned about their families’ welfare in the future. They don’t focus only on managing investments of the financial assets they…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE 👉 http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

-

CLICK HERE 👉 http://watchibc.com/ Welcome back to Bankers Vault! Today, we break down the key concepts of financial independence versus financial freedom and introduce the family banking system as a powerful way to control the banking function in your life. We explain how to free up cash flow through debt recapture, build a sustainable system…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

-

Every major purchase comes down to three choices: lease it, buy it with cash, or finance it. Jason Weiss, a financial strategist, breaks down how business owners can optimize their cash flow while acquiring assets. Instead of tying up capital, strategic financing allows you to keep money moving where it works best. This approach applies…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!