Category: Financial Education

-

Meeting Your Financial Goals

Read more »: Meeting Your Financial GoalsPersonal Finance Canada What comes to mind when thinking of your personal finances? Money makes everyone’s world go round. It is a medium of exchange that provides for our lifestyle today and in the future. Even though we all make money, many of us have little or no knowledge of how it works. It is…

-

Creating A Private Family Banking Strategy

Read more »: Creating A Private Family Banking StrategyWhat is the main cause of concern among wealthy families around the world? Our research shows that families who are remarkably wealthy are keen and deeply concerned about their families’ welfare in the future. They don’t focus only on managing investments of the financial assets they…

-

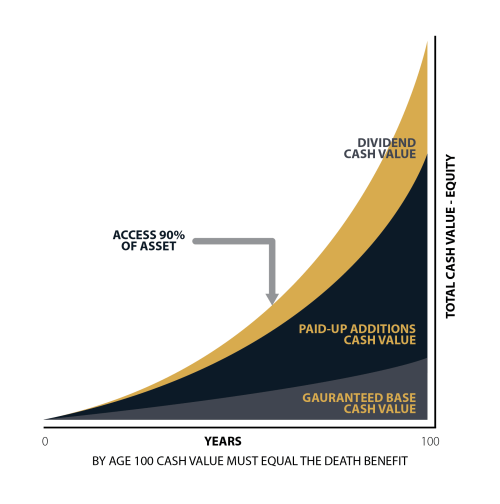

The Secrets to Paid Up Additions

Read more »: The Secrets to Paid Up AdditionsIn this article, we’ll talk about paid-up additions and how it suits this often neglected, and often misunderstood, financial freedom tool known as participating dividend paying whole life insurance coverage.

-

What Is Cash Surrender Value?

Read more »: What Is Cash Surrender Value?Cash surrender value is the exact amount of money you will get if you decide to cancel a permanent life insurance policy before it matures or before you pass away. Cash surrender value is an asset you own. On a permanent life insurance contract there are a number of ways…

-

Cash Flow Banking Strategy

Read more »: Cash Flow Banking StrategyWhat is Cash Flow banking? Cashflow Banking or Cash Flow Banking is a strategy used to describe a way to capture the opportunity cost on your cash flow as it moves through your life. The banking aspect refers to the way you can transactionally access this stored cash flow from the cash values of a…

-

Velocity Banking

Read more »: Velocity BankingGetting out of debt can be a trying experience. Canadians have been accumulating debt at lightning speeds, and it makes sense that we would look for ways to get out of debt just as fast. Head over to the internet and search for the Hail Mary solutions late at night. Something to help…

-

Risk management

Read more »: Risk managementOne of the fundamental pillars of risk management is investment diversification. Prudent Advisors recommend their Clients strategically spread investments across a range of assets, such as stocks, bonds, and real estate, reducing exposure to the volatility of any single investment. This diversification approach aims to optimize returns while minimizing the impact of market fluctuations, aligning…

-

Insurable interest

Read more »: Insurable interestWhat is Insurable interest? The term “insurable interest” is used to describe the legal and financial interests of a person or company in an insurance policy. It means, in simple terms, that the person or entity buying the insurance has a stake in protecting the insured property or person. The stake is to ensure that…

-

Inheritance tax with Ascendant Financial

Read more »: Inheritance tax with Ascendant FinancialWhat is Inheritance tax? The term Inheritance Tax (IHT), stands for an amount that’s payable by a person who has received assets upon another individual’s death. The asset range includes cash, real estate properties, business shares among others. This emphasizes how important it is to understand optimal inheritance tax literature takes into account these factors…