-

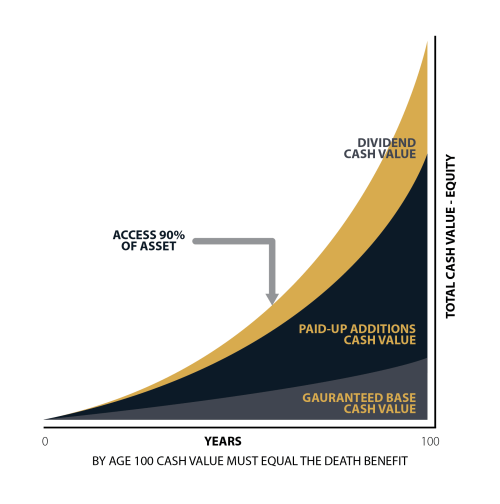

The Secrets to Paid Up Additions

Read more »: The Secrets to Paid Up AdditionsIn this article, we’ll talk about paid-up additions and how it suits this often neglected, and often misunderstood, financial freedom tool known as participating dividend paying whole life insurance coverage.

-

Borrowing money from life insurance

Read more »: Borrowing money from life insuranceBenefits of Borrowing money from life insurance The ability to borrow from a life insurance asset, called cash value, has been common knowledge for many years. However, there are many details about the advantages of borrowing from insurance that are unknown to the general public. When used intentionally, borrowing from par whole life insurance can…

-

What Is Cash Surrender Value?

Read more »: What Is Cash Surrender Value?Cash surrender value is the exact amount of money you will get if you decide to cancel a permanent life insurance policy before it matures or before you pass away. Cash surrender value is an asset you own. On a permanent life insurance contract there are a number of ways…

-

What is Mortgage Life Insurance

Read more »: What is Mortgage Life InsuranceWhat is Mortgage Life Insurance Mortgage lenders and banks offer consumers mortgage life insurance which is meant to clear off a family’s mortgage balance should the borrower(s) die. While this is a convenient option to consider, like anything, there are pros and cons. In the case of mortgage life insurance, the risk and absence of…

-

What Is A Participating Policy?

Read more »: What Is A Participating Policy?Participating policy – What to expect. A participating policy is an insurance contract that pays dividends to the policy holder. Dividends are generated from the profits of the insurance company that sold the policy and are typically paid out on an annual basis over the life of the policy. Most policies also include a final…

-

Cash Flow Banking Strategy

Read more »: Cash Flow Banking StrategyWhat is Cash Flow banking? Cashflow Banking or Cash Flow Banking is a strategy used to describe a way to capture the opportunity cost on your cash flow as it moves through your life. The banking aspect refers to the way you can transactionally access this stored cash flow from the cash values of a…

-

What Is Permanent Life Insurance

Read more »: What Is Permanent Life InsuranceInsured Retirement Plans (IRPs) allow you to have your cake and eat it too. In the article, we’ll be exploring what IRPs are, how they work, plus the pros and cons of getting one. Finally, we’ll tell you what kind of individual is best suited for this strategy. Insurance can be complicated. So, before we…

-

Velocity Banking

Read more »: Velocity BankingGetting out of debt can be a trying experience. Canadians have been accumulating debt at lightning speeds, and it makes sense that we would look for ways to get out of debt just as fast. Head over to the internet and search for the Hail Mary solutions late at night. Something to help…

-

The Insured Retirement Planning Guide

Read more »: The Insured Retirement Planning GuideInsured retirement plan (IRPs) Insured Retirement Plans (IRPs) allow you to have your cake and eat it too. In the article, we’ll be exploring what IRPs are, how they work, plus the pros and cons of getting one.

-

Retirement Planning Guide for Canadians

Read more »: Retirement Planning Guide for CanadiansInsured retirement plan (IRPs) Insured Retirement Plans (IRPs) allow you to have your cake and eat it too. In the article, we’ll be exploring what IRPs are, how they work, plus the pros and cons of getting one.

-

Becoming Your Own Banker Training

Read more »: Becoming Your Own Banker TrainingBecoming Your Own Banker is a financial strategy focused on your benefits not the banks benefits. A way to grow your future financial success and the potential of a dividend-paying life insurance. It’s neither a sales nor a marketing tool for whole life insurance brokers.

-

Risk management

Read more »: Risk managementOne of the fundamental pillars of risk management is investment diversification. Prudent Advisors recommend their Clients strategically spread investments across a range of assets, such as stocks, bonds, and real estate, reducing exposure to the volatility of any single investment. This diversification approach aims to optimize returns while minimizing the impact of market fluctuations, aligning…